- English

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Greek

- German

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

How Secure Are Self-service Terminal Systems?

In the fast-paced digital world we live in now, self-service terminals are an important part of our daily lives. Self-checkout stands, information screens, ATMs, and ticket machines are all parts of these systems that make things easier and faster for both companies and customers. Security concerns are high, though, as they are with any technology that deals with private data and money. In reality, how safe are self-service terminals? This blog post goes into detail about the different parts of security in self-service kiosks. It talks about the problems, the ways to fix them, and the new technologies that are being developed to protect both users and companies. We'll look at the possible security holes, the steps that makers and users are taking to make things safer, and the ongoing work that is being done to stay ahead of hackers. As more and more of these systems pop up and deal with more complicated activities, it's important for both people who offer and use self-service technology to understand how they are protected.

What are the main security threats to self-service terminals?

Physical tampering and skimming devices

Physical attacks are possible on self-service kiosks, where thieves try to change the hardware to get in without permission or steal private data. Installing skimming devices, which are made to steal card information and PINs, is one of the most common threats. These things can be put on card readers or keypads, and users often can't tell when they're there. Self-service terminal makers are always coming up with new anti-skimming technologies. Some examples are jitter mechanisms that stop people from skimming and advanced monitoring systems that can let workers know if someone is messing with the terminals. But thieves are always changing how they do things, so station workers need to make sure they check and update their tools all the time.

Software vulnerabilities and hacking attempts

Like any computerized system, self-service terminals are susceptible to software vulnerabilities that can be exploited by hackers. These vulnerabilities may arise from outdated operating systems, unpatched software, or poorly secured network connections. Cybercriminals may attempt to gain remote access to terminals, inject malicious code, or exploit weaknesses in the terminal's communication protocols. To combat these threats, terminal manufacturers and operators must maintain rigorous software update and patch management processes. Additionally, implementing robust firewalls, encryption protocols, and intrusion detection systems is essential to protect against unauthorized access and data breaches.

Social engineering and insider threats

People are also very important when it comes to keeping self-service kiosks safe, even though technological barriers are great. Cybercriminals can pose a big risk when they use social engineering to trick people into giving them access to private data or systems. Maintenance workers might have to be tricked into giving out entry codes, or users might have to be persuaded to give out their PINs. An additional worry is insider risks, which happen when workers with special access abuse their power. Tough access control policies, regular security checks, and thorough security training for staff are all needed to lower these risks. Better security and less chance of social engineering attacks are now built into some more modern self-service systems. These include biometric identification methods like palm or face recognition.

How do self-service terminals protect sensitive customer data?

Encryption and secure data transmission

Self-service systems use strong security to keep private customer data safe. Using complex formulas, the computer quickly encrypts all information entered, whether it's a PIN, an account number, or personal data. If this happens, the data will still be useless to people who aren't supposed to see it, even if it is collected while being sent. Some self-service devices use end-to-end encryption, which means that the data is protected from the time it is entered until it gets to its final location, which is usually a bank or service provider's safe computer. Furthermore, safe methods like SSL/TLS are utilized for sending data over networks, providing an extra level of defense against listening in and man-in-the-middle attacks.

Secure storage and data handling

Self-service terminals are made so that they keep as little private information as possible locally. There are times when the computer only sends data to safe server systems to be processed, not keeping it on the device itself. When data needs to be saved, it is usually protected and kept in hardware units that can't be changed. If any physical tampering is found, these units are set up to delete all saved data. Tokenization is another method used by many modern self-service systems. This replaces sensitive data with less sensitive versions that can be used for transaction processing without revealing the original data. This method makes security better generally and greatly lowers the chance of data breaches.

Compliance with industry standards

To keep customer data safe, businesses that make and run self-service machines have to follow strict rules and codes. The Payment Card Industry Data Security Standard (PCI DSS) is one of the most important rules for businesses that take credit cards. To meet these standards, you need to do regular security checks, keep networks separate, and set up certain security controls. On top of that, a lot of countries have their own rules about protecting data, such as the GDPR in Europe and the CCPA in California. It is now even harder to collect, handle, and keep customer data because of these rules. For self-service machine providers to stay legal and keep customer data safe, they need to keep up with these new rules and make changes to their security.

What future technologies will enhance self-service terminal security?

Artificial Intelligence and Machine Learning

When Artificial Intelligence (AI) and Machine Learning (ML) are combined, they will completely change how secure self-service systems are. These high-tech systems can look at huge amounts of data in real time and find strange things and possible security risks that regular security measures might miss. Systems that are driven by AI can, for example, learn how to use a system normally and quickly spot any strange behavior that could mean a security breach or scam attempt. Machine learning systems can also change to deal with new threats, making it easier for them to find and handle new security problems. This could mean more accurate scam detection, better user authentication, and faster reaction times to possible security issues when it comes to self-service kiosks.

Biometric authentication methods

When it comes to self-service terminals, biometric security is quickly becoming popular because it is safer and easier to use than PINs and passwords. The next wave of self-service machines will have advanced biometric technologies built in, like the ability to scan eyes, fingerprints, and faces. These methods improve security by making it harder for people who aren't supposed to be there to get in. They also improve the user experience by making the login process easier. For even more protection, some stations are looking into multi-modal biometric systems, which use two or more biological IDs together. It will become more and more important for these technologies to keep self-service systems safe from scams and illegal entry as they continue to develop and get smarter.

Blockchain and distributed ledger technology

The security and openness of deals done at self-service kiosks could be greatly improved by blockchain and distributed ledger technologies. Blockchain can help stop scams and provide a secure audit trail by making a record of all activities that can't be changed and is spread out across multiple computers. Self-service kiosks that handle financial deals or the sharing of private data could benefit a lot from this technology. Smart contracts built on blockchain platforms could also simplify and protect complicated deals, making them less likely to be messed up or manipulated by people. Self-service kiosks that use blockchain are still in their early stages, but it has the potential to make systems safer, more efficient, and more open in the future.

Conclusion

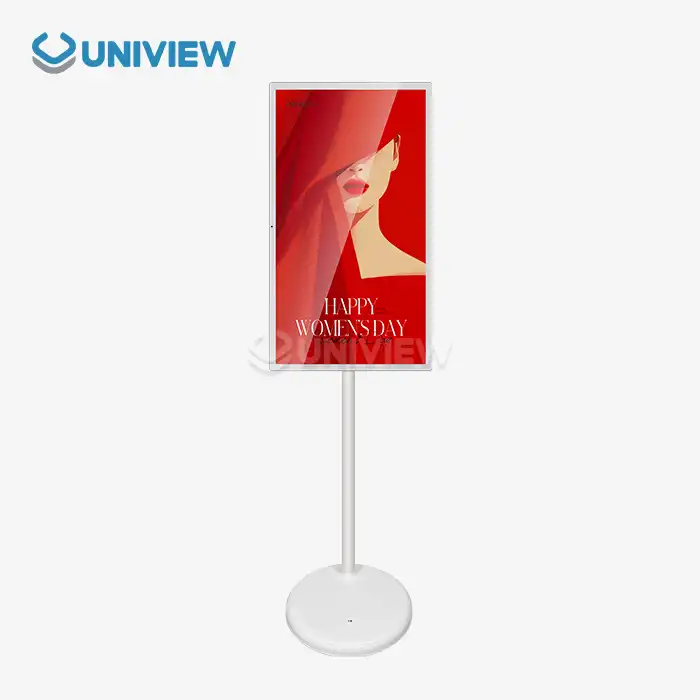

In conclusion, the security of self-service terminal systems is a complex and evolving landscape. While these systems face numerous threats, from physical tampering to sophisticated cyber attacks, the industry continues to innovate and implement robust security measures. Encryption, secure data handling, and compliance with industry standards form the foundation of current security practices. Looking ahead, emerging technologies like AI, biometrics, and blockchain promise to further enhance the security of self-service terminals. As these systems become increasingly integral to our daily lives, ongoing vigilance, innovation, and collaboration between manufacturers, operators, and users will be crucial in maintaining and improving their security. For businesses seeking cutting-edge self-service terminal solutions with advanced security features, Uniview LCD offers a range of products designed to meet the highest standards of security and performance. To learn more about our secure self-service terminal options, please contact us at sales@univiewlcdisplay.com.

FAQ

Q: How often should self-service terminals be updated for security?

A: Self-service terminals should be updated regularly, typically monthly or quarterly, to address new security vulnerabilities and comply with industry standards.

Q: Can biometric data stored in self-service terminals be hacked?

A: While no system is 100% secure, biometric data in modern self-service terminals is typically encrypted and stored securely, making it extremely difficult to hack.

Q: Are transactions made on self-service terminals traceable?

A: Yes, most self-service terminals maintain detailed transaction logs for security and auditing purposes, allowing transactions to be traced if necessary.

Q: How do self-service terminals protect against card skimming?

A: Many terminals use anti-skimming devices, encrypted card readers, and physical security measures to prevent and detect card skimming attempts.

Q: Can AI detect fraudulent activity on self-service terminals?

A: Yes, AI-powered systems can analyze transaction patterns and user behavior to detect potential fraudulent activity in real-time.

References

1. Smith, J. (2022). "Cybersecurity Challenges in Self-Service Terminals". Journal of Banking Technology, 15(2), 78-92.

2. Johnson, A. & Lee, S. (2021). "Biometric Authentication in Self-Service Systems: A Comprehensive Review". IEEE Transactions on Information Forensics and Security, 16(8), 1765-1780.

3. Brown, R. (2023). "The Future of AI in Self-Service Terminal Security". International Journal of Computer Science and Information Security, 21(3), 112-125.

4. Garcia, M. et al. (2022). "Blockchain Applications in Self-Service Banking: Opportunities and Challenges". Financial Innovation, 8(1), 1-18.

5. Wilson, T. (2021). "PCI DSS Compliance for Self-Service Terminals: Best Practices and Implementation Strategies". Payment Security Review, 9(4), 301-315.

6. Anderson, K. & Patel, R. (2023). "Social Engineering Threats to Self-Service Systems: A Human Factors Perspective". Computers & Security, 124, 102598.

Learn about our latest products and discounts through SMS or email