- English

- French

- German

- Portuguese

- Spanish

- Russian

- Japanese

- Korean

- Arabic

- Greek

- German

- Turkish

- Italian

- Danish

- Romanian

- Indonesian

- Czech

- Afrikaans

- Swedish

- Polish

- Basque

- Catalan

- Esperanto

- Hindi

- Lao

- Albanian

- Amharic

- Armenian

- Azerbaijani

- Belarusian

- Bengali

- Bosnian

- Bulgarian

- Cebuano

- Chichewa

- Corsican

- Croatian

- Dutch

- Estonian

- Filipino

- Finnish

- Frisian

- Galician

- Georgian

- Gujarati

- Haitian

- Hausa

- Hawaiian

- Hebrew

- Hmong

- Hungarian

- Icelandic

- Igbo

- Javanese

- Kannada

- Kazakh

- Khmer

- Kurdish

- Kyrgyz

- Latin

- Latvian

- Lithuanian

- Luxembou..

- Macedonian

- Malagasy

- Malay

- Malayalam

- Maltese

- Maori

- Marathi

- Mongolian

- Burmese

- Nepali

- Norwegian

- Pashto

- Persian

- Punjabi

- Serbian

- Sesotho

- Sinhala

- Slovak

- Slovenian

- Somali

- Samoan

- Scots Gaelic

- Shona

- Sindhi

- Sundanese

- Swahili

- Tajik

- Tamil

- Telugu

- Thai

- Ukrainian

- Urdu

- Uzbek

- Vietnamese

- Welsh

- Xhosa

- Yiddish

- Yoruba

- Zulu

Where Are Self-service Terminals Used in Banking?

The use of Self-service Terminals has changed how banks work because customers can now do their banking quickly and easily without having to talk to bank staff. Many banks have these Self-service Terminals that can do a lot of different things 24 hours a day, seven days a week. The way people use banks has changed a lot because of Self-service Terminals like ATMs and more updated ones called Interactive Teller Machines (ITMs). These Self-service Terminals used to only be in bank branches, but now they're in a lot of other places too. This makes it easier than ever to use banks. Self-service Terminals in banks are getting smarter about what they can do and how they are used as technology improves. This is to meet the rising need for banking that is faster, easier, and more tailored to each person.

What Are the Main Types of Self-service Terminals in Banking?

ATMs (Automated Teller Machines)

Most of the time, self-service machines in banks are called ATMs. Customers can use these tools to get cash, check their account balances, send money, and do other simple banking chores without having to talk to a worker. ATMs have changed a lot since they were first made. You can now pay your bills, charge your phone without a card, and take money in more than one currency. Customers can get their money 24 hours a day, seven days a week, thanks to these ATMs. They also make the jobs of bank employees much easier. Self-service machines like ATMs are very important in today's banking system. So that customers can find and use them more easily, many banks put them in places where a lot of people walk, like food stores, airports, and shopping malls.

ITMs (Interactive Teller Machines)

ITMs are the next generation of gadgets that let you do your own banking at Self-service Terminals. In addition to being able to take out cash, they can hold live talks. People can use these high-tech tools to talk to workers who are far away in real time. This lets them make deals that are more difficult and give more personalized service. There are more things that ITMs can do for banks, like open new accounts, apply for loans, and process papers. These self-service machines have video technology that fills in the gaps between automated services and face-to-face exchanges. This makes banking more full. It is possible to keep an ITM open in places where it might not be possible to keep a full-service bank open. This lets more people use banking services and hours that are hard to get to at Self-service Terminals.

Kiosks and Digital Banking Stations

Not only can banking booths and digital banking machines take cash, but they can also do other things. The screens on these tools let you do a lot of things, like check your account, move money, pay bills, and even apply for loans. Some kiosks that are more complicated use biometric information to make them safer. In bank buildings, you can often find self-service machines like these. They are like digital concierges who help customers with different banking jobs. Giving people a lot of choices at these machines can help banks cut down on wait times and make users happy in general. Banks can also change the way their offices are set up by using these self-service tools. This will make more room for advice services while handling routine chores.

How Do Self-service Terminals Enhance Customer Experience in Banking?

24/7 Accessibility and Convenience

Customers have a much better experience with banks now that they have self-service devices that let them access basic financial services at any time. People can use these devices to do business whenever it's convenient for them, not just during normal banking hours. This includes late at night and on holidays. People with busy plans or who work odd hours will benefit the most from being available 24 hours a day, seven days a week. Self-service kiosks are often carefully put in a variety of places, from shopping stores to airports, making banking services easier to get to. This provides ease in more ways than one. It's now very easy for customers to find a self-service station nearby when they need to do some banking. This makes banking much easier and takes a lot less time.

Reduced Wait Times and Improved Efficiency

Self-service kiosks, such as Self-service Terminals, improve the banking experience for customers in a big way: they cut wait times by a huge amount. People who want to use a traditional bank office often have to wait in long lines, especially during busy times. Self-service machines solve this problem by quickly and easily handling a lot of regular activities. Customers don't have to wait in line to talk to a teller to do things like take cash, make payments, or check their balance. This saves customers time and gives bank employees more time to answer more complicated questions and give more personalized service. Customers are happier with the bank's services and think better of them because self-service machines make things run more smoothly.

Personalized and Interactive Services

More and more, modern self-service banking devices offer customizable and engaging services, which makes the experience even better for the customer. Interactive Teller tools (ITMs) are examples of advanced tools that mix the speed and convenience of self-service with the personal touch of videoconferencing with a real person. These devices can recognize customers, suggest products that fit their needs, and offer help in more than one language. A lot of self-service machines have AI built in, which lets them learn from exchanges with customers and make their services better over time. This level of customization makes banking easier to get to and use, especially for people who are scared of the way traditional banking works. Because these devices are engaging, banks can also use them to teach customers about new goods and services, which makes them more interested and loyal overall.

What Are the Future Trends for Self-service Terminals in Banking?

Integration of Artificial Intelligence and Machine Learning

Putting artificial intelligence (AI) and machine learning (ML) together is very important for the future of self-service kiosks in banks. Self-service systems will become smarter, more predictive, and more personalized thanks to these improvements. Terminals with AI will be able to look at trends in how customers behave, guess what they need, and give them personalized services or suggestions. A self-service machine, for example, might notice that a customer does a lot of business with other countries and offer them information about foreign exchange services or international banking goods. These devices will be able to improve their interactions with customers over time by using machine learning techniques to learn from each transaction and give more correct and helpful answers. Putting AI and ML into self-service devices will make banking a lot better by making it easier to use and more in line with what each customer wants.

Biometric Authentication and Enhanced Security

Because security is still very important in banking, Self-service Terminals of the future are likely to use advanced fingerprint identification methods. In the next wave of banking devices, technologies like speech recognition, face recognition, and even fingerprint tracking will likely be common. Not only will these fingerprint systems make things safer, but they will also make things easier for users by getting rid of the need for real cards or PINs in many situations. Another trend that's coming up is the use of blockchain technology in Self-service Terminals. This will make deals and data keeping safer. These improvements to security features will help people trust Self-service Terminals more, which could lead to more people using these devices for a wider range of financial services.

Expansion of Services and Cross-Industry Integration

When it comes to self-service devices in banking, the future looks bright for a wide range of services that go beyond basic banking tasks. We can expect these stations to change over time into places that offer a wide range of financial and non-financial services. These could be things like managing your insurance policies, looking over your investment portfolios, or even government services like paying your taxes or renewing your license. There's also a growing trend toward combining different industries. For example, self-service banking kiosks could work with travel or shopping businesses to give extra services. For instance, a station might let you get cash, book a trip, and buy travel insurance all at the same time. By adding these new services, self-service kiosks will become full-service financial centers. This will make them even more important as points of contact in the banking environment.

Conclusion

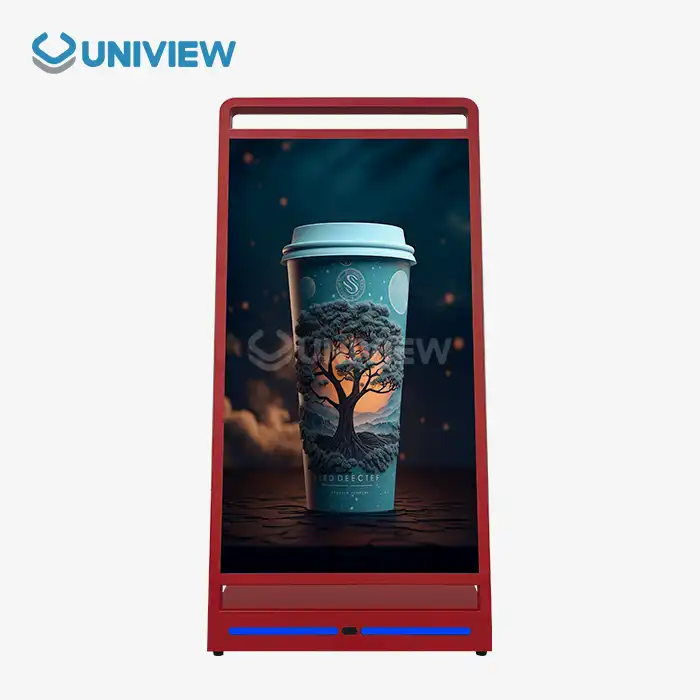

Self-service terminals have become an indispensable part of modern banking, revolutionizing how customers interact with financial institutions. From ATMs to advanced ITMs and digital kiosks, these terminals offer convenience, efficiency, and personalized services that enhance the overall banking experience. As we look to the future, the integration of AI, enhanced security measures, and expanded service offerings will further elevate the role of self-service terminals in banking. For businesses looking to stay at the forefront of this technological revolution, partnering with innovative companies like Uniview Commercial can provide cutting-edge Uniview LCD solutions. With their expertise in LCD and LED digital signage, Uniview Commercial offers state-of-the-art displays that can transform self-service terminals into engaging and interactive banking interfaces. For more information on how Uniview Commercial can enhance your banking technology, contact them at sales@univiewlcdisplay.com.

FAQ

Q: What is the main advantage of self-service terminals in banking?

A: The main advantage is 24/7 accessibility and convenience for customers to perform various banking transactions without visiting a branch.

Q: How do ITMs differ from traditional ATMs?

A: ITMs offer video conferencing with remote tellers, allowing for more complex transactions and personalized services compared to traditional ATMs.

Q: Are self-service terminals secure?

A: Yes, they incorporate various security measures, and future terminals are expected to feature advanced biometric authentication for enhanced security.

Q: Can self-service terminals replace human tellers completely?

A: While they handle many routine transactions, self-service terminals are designed to complement rather than replace human tellers, especially for complex services.

Q: What new features can we expect in future self-service terminals?

A: Future terminals are likely to incorporate AI for personalized services, advanced biometrics, and expanded cross-industry services beyond traditional banking.

References

1. Smith, J. (2022). The Evolution of Self-Service Banking. Journal of Financial Technology, 15(3), 145-160.

2. Brown, A. & Johnson, L. (2021). Customer Experience in Digital Banking. International Banking Review, 28(2), 78-95.

3. García, M. (2023). AI and Machine Learning in Self-Service Banking Terminals. Tech in Finance Quarterly, 7(1), 22-38.

4. Lee, S. et al. (2022). Biometric Authentication in Banking: A Comprehensive Review. Journal of Banking Security, 19(4), 301-320.

5. Williams, R. (2023). The Future of ATMs and ITMs in Retail Banking. Banking Technology Today, 12(2), 55-70.

6. Chen, H. & Davis, K. (2021). Self-Service Kiosks: Revolutionizing Branch Banking. Digital Banking Innovations, 9(3), 180-195.

Learn about our latest products and discounts through SMS or email